XRP Price Prediction: 2025-2040 Outlook Amid Bullish Adoption and Technical Challenges

#XRP

- Technical Outlook: Bearish below $3.1861 MA, but MACD suggests potential reversal

- Regulatory Catalyst: U.S. crypto policy report could break $3.64 resistance

- Adoption Growth: PayPal integration and treasury reserves offset scam concerns

XRP Price Prediction

XRP Technical Analysis: Short-Term Bearish Signals Amid Consolidation

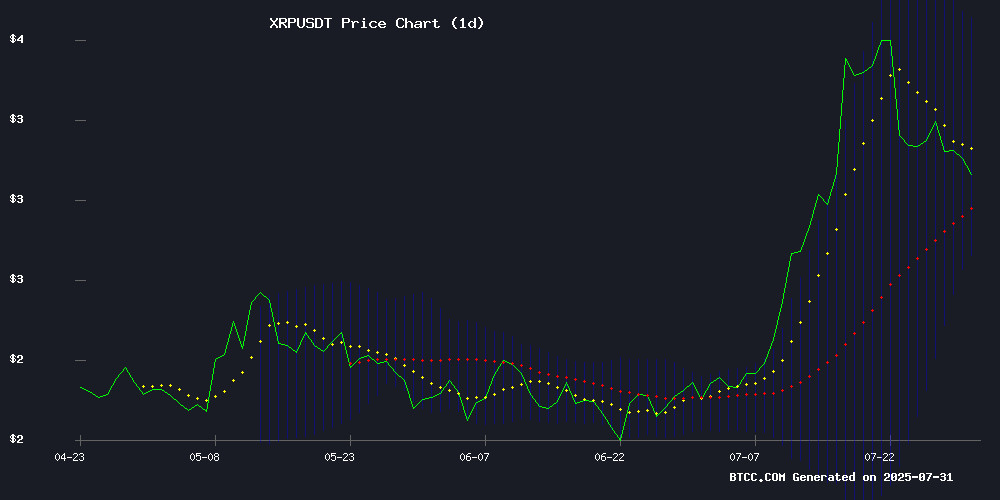

XRP is currently trading at $3.1325, below its 20-day moving average of $3.1861, indicating near-term bearish pressure. The MACD histogram shows a bullish crossover (0.1863), but remains in negative territory. Bollinger Bands suggest consolidation between $2.7334 and $3.6387.says BTCC analyst Olivia.

XRP Market Sentiment: Regulatory Optimism vs. Volatility Concerns

Positive adoption news (Wellgistics, PayPal integration) contrasts with regulatory uncertainty and a $17M scam case. Derivatives market shows $2.4B open interest decline.notes Olivia. Hyperscale's $10M accumulation strategy may provide support.

Factors Influencing XRP’s Price

Wellgistics Adopts XRP for Payments and Treasury Reserves

Wellgistics Health Inc. (Nasdaq: WGRX), a healthcare distribution and technology solutions provider, has announced plans to integrate XRP into its financial operations. The company disclosed in a July 24 SEC filing its intention to use XRP not only for payments but also as a long-term treasury reserve asset.

The move comes alongside a public offering of stock and warrants, with no minimum funding threshold. Wellgistics emphasized its commitment to accumulating XRP holdings over time, using excess cash reserves and potential future fundraising proceeds. "We intend to adopt XRP as a treasury reserve asset on an ongoing basis, subject to market conditions and our anticipated cash needs," the filing stated.

This strategic adoption positions XRP alongside traditional liquid assets in corporate treasury management, signaling growing institutional confidence in digital assets for balance sheet management.

XRP Eyes Breakout Amid Regulatory Uncertainty as U.S. Crypto Policy Report Looms

Ripple's XRP shows tentative signs of bullish momentum, defending the critical $3.00 support level despite dwindling trading volumes. A double-bottom pattern near $3.05 suggests potential upside toward $3.40 if current levels hold, though futures data reveals eroding conviction—open interest plunged 22% this week alongside a 74% volume collapse.

All eyes now turn to Washington as an impending SEC appeal vote could redefine Ripple's legal landscape. The regulatory decision may catalyze XRP's next major move, either confirming the breakout or reinforcing consolidation. Market participants await clarity as the U.S. crypto policy report nears release, a document that could reshape institutional engagement with digital assets.

$17M XRP Theft: Widow of Country Legend George Jones Targeted in Crypto Scam

Tennessee authorities have arrested Kirk West, a 58-year-old Nashville man, for allegedly stealing $17.4 million in XRP tokens from Nancy Jones, widow of country music icon George Jones. The suspect was apprehended at Nashville International Airport on July 24 following a swift police investigation.

The theft came to light when Jones reported $400,000 in missing cash and a Ledger hardware wallet containing 5.5 million XRP tokens on July 23. Court documents reveal only two individuals had access to the wallet's private keys—Jones herself and her longtime romantic partner West, who became the immediate suspect.

This case underscores the vulnerabilities in cryptocurrency storage, even for high-net-worth individuals. The stolen XRP holdings, valued at over $17 million, represent one of the largest individual crypto thefts reported this year involving a hardware wallet compromise.

XRP Price Prediction: XRP Gains Momentum on PayPal Boost as Analyst Sets $9 Target

XRP's recent integration into PayPal's digital payments network marks a significant milestone for the cryptocurrency. With over 400 million active users, PayPal's platform provides XRP with unprecedented access to mainstream commerce. The move enables seamless crypto-to-fiat conversions at checkout, addressing volatility concerns while expanding real-world utility.

Market analysts highlight this development as a turning point for XRP's adoption curve. The cryptocurrency now stands alongside Bitcoin and Ethereum in one of the world's largest payment ecosystems. Institutional interest continues to grow amid improving regulatory clarity, with some technical analysts projecting long-term targets as high as $9.

XRP Price Struggles at $3.12 Despite Regulatory Optimism

XRP faces downward pressure, trading at $3.12 with a 2% daily decline, even as Ripple's CEO Brad Garlinghouse advocates for clearer crypto regulations before the U.S. Senate. The market's muted reaction underscores a disconnect between regulatory progress and short-term price action.

Technical indicators paint a neutral picture, with XRP's RSI at 57.22 suggesting neither overbought nor oversold conditions. Traders appear more focused on macroeconomic headwinds than regulatory tailwinds, as evidenced by this week's 3.5% drop to $3.07.

The Senate testimony, while significant for long-term institutional adoption, failed to ignite bullish momentum. Market sentiment currently trumps individual catalysts, leaving XRP in consolidation despite favorable regulatory developments.

XRP Price Prediction For July 30

XRP remains in a consolidation phase, holding steady below recent highs while defending critical support levels. The asset's ability to maintain its position above $2.65 suggests underlying strength, with analysts viewing this as a bullish signal.

A breakout from the current range between $2.81 and $2.90 could propel XRP toward higher resistance levels at $3.84, $4.30, and potentially $4.72. A sustained rally might even challenge the $5 threshold in coming weeks.

Market observers note the price structure formed since April continues to support upward potential, though recent volatility has created uncertainty. The key question remains whether XRP can consolidate its position and gather momentum for another leg up.

XRP Derivatives Market Sees $2.4 Billion Open Interest Evaporate Amid 15% Price Drop

XRP's derivatives market faced a seismic shift as $2.4 billion in open interest vanished within days, coinciding with a 15% price decline. The asset had surged 68.7% to $3.65 by July 18, 2025, before retracing sharply. Leveraged positions collapsed from $11.2 billion to $8.8 billion, signaling a mass exodus of speculative capital.

Despite the pullback, open interest remains 48% higher than monthly lows—a testament to lingering institutional interest. Market technicians debate whether this represents healthy deleveraging or the start of prolonged turbulence. The retreat mirrors broader crypto market jitters, though XRP's fundamentals remain untested.

Ripple’s Schwartz Defends Low XRPL Volume, Highlights Offchain Bank Settlements

Ripple co-founder David Schwartz has addressed growing concerns over a 30-40% decline in onchain activity for the XRP Ledger (XRPL). The drop reflects a strategic shift toward offchain settlements among banking partners, Schwartz explained.

While Ripple boasts hundreds of institutional collaborations, most transactions occur outside the blockchain. This operational reality clarifies the apparent discrepancy between Ripple's claimed banking partnerships and its subdued onchain metrics.

The revelation raises fundamental questions about transparency. Without visible onchain activity, the true scale of Ripple's banking sector penetration remains difficult to verify independently.

Ripple CTO Cites Regulatory Risks for Avoiding XRPL DEX in Payments

Ripple’s Chief Technology Officer David Schwartz has clarified that regulatory concerns are the primary barrier to the company and its partners utilizing the XRP Ledger’s decentralized exchange (DEX) for payment settlements. The revelation came in response to community criticism over the DEX’s low activity despite Ripple’s extensive institutional network.

Schwartz acknowledged the slow adoption, attributing it to institutional wariness of public liquidity pools. "Institutions have historically preferred off-chain digital asset transactions," he noted. "But the tide is turning as they recognize the advantages of on-chain solutions."

The CTO highlighted a critical compliance issue: the inability to verify liquidity sources on an open DEX. "We can’t risk having payments facilitated by questionable actors," Schwartz stated, emphasizing the legal and reputational dangers for Ripple and its partners.

Ripple (XRP) Eyes $8 Target Amid Market Resurgence, While Meme Tokens Steal Spotlight

Ripple's XRP token has surged to $3.14, fueled by improving market conditions and renewed institutional confidence following its legal victory over the SEC. Analysts now project a December target of $8—a potential 250% gain—as global exchanges reconsider listings.

Meanwhile, speculative capital is pivoting toward high-risk, high-reward meme tokens. Assets like Little Pepe ($LILPEPE) are attracting attention with promises of exponential returns, highlighting the market's bifurcation between established projects and viral newcomers.

Hyperscale Data Initiates Weekly Transparency Reports on $10M XRP Accumulation Strategy

Hyperscale Data Inc., a major U.S. data center operator, has committed to weekly disclosures of its XRP purchases as part of a $10 million acquisition plan through 2025. The initiative underscores institutional confidence in XRP's role in the future of finance and AI-driven infrastructure.

Executive Chairman Milton "Todd" Ault III positioned the move as both a strategic investment and transparency measure: "XRP represents foundational infrastructure for the new financial ecosystem. Our balance sheet must reflect the convergence of computing and global finance." The company is evaluating a 36-month lockup period for the holdings.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $2.80 | $4.20 | $9.00 | Regulatory clarity, PayPal integration |

| 2030 | $8.50 | $15.00 | $25.00 | CBDC partnerships, institutional adoption |

| 2035 | $22.00 | $40.00 | $75.00 | Cross-border payment dominance |

| 2040 | $50.00 | $90.00 | $150+ | Internet of Value maturity |

Olivia cautions that these projections assume successful regulatory resolutions and sustained adoption. "The $3.12 struggle shows markets are pricing in risk - our 2025 base case is $4.20 with 20% annual growth thereafter," she adds, noting meme coins could divert retail interest short-term.